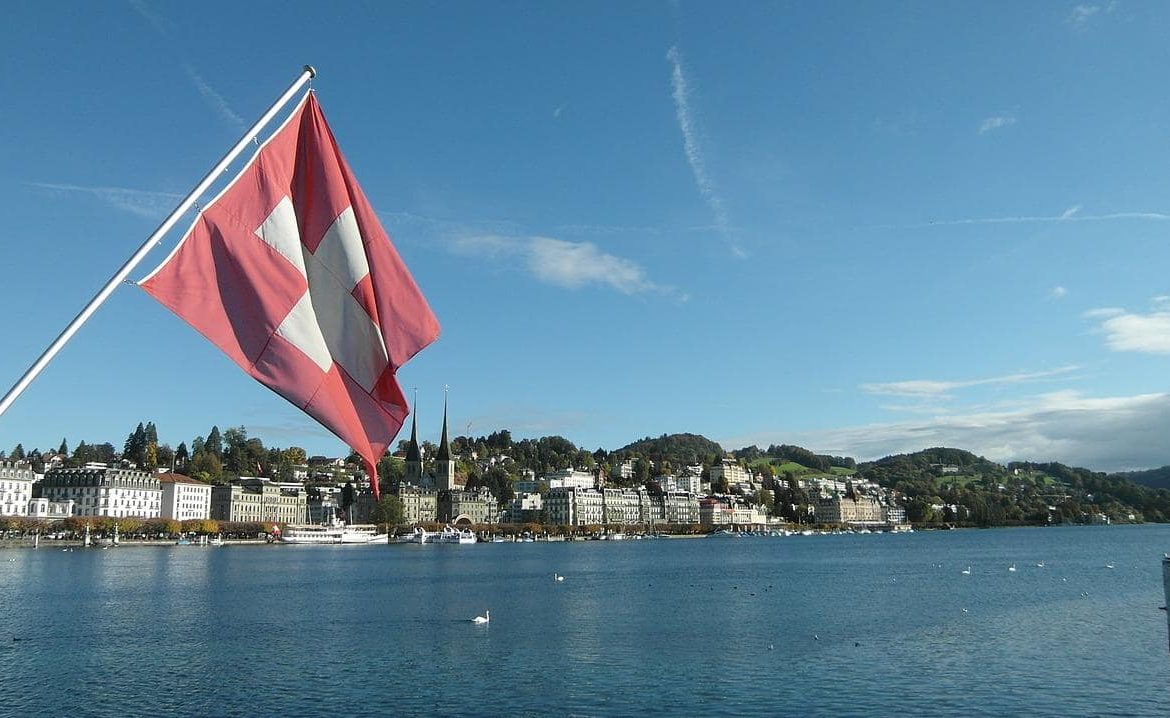

Real Estate Trends in Switzerland in 2022

Both the Swiss and Verbier real estate market have been popular for decades now. It’s a synonym for stability, growth, and profitability that properties bring to investors and homeowners.

Over the past few decades, property prices have been on a continuous rise. But how has the Swiss real estate market reacted to the latest changes in the global economy?

When it comes to international real estate markets, it’s hard to find one that is better-positioned than the one in Switzerland. Last year, the Swiss real estate market saw a boom thanks to the stability, growth, and profitability that properties bring to investors and homeowners.

If you look at the situation historically, the Swiss real estate market and Verbier real estate market have done well. Property prices have been on a continuous rise in the past decades and so have real estate funds.

However, the multiple crises in the world made people wonder if Swiss housing is heading for a fall. Some claim that the Swiss property market faces a bleak future despite record values, which has caused concern.

There are multiple reasons why this is happening. Moreover, investors are starting to wonder what the future holds for the Swiss real estate market. So let’s take a closer look.

Inflation and rates

Whenever the world or a country goes through periods of high inflation, real estate usually performs well. But the question we need to be asking ourselves is what happens to the real estate market when interest rates begin to rise. This will probably happen in late 2022 or more probably in 2023.

During inflation that was happening in the late 1980s, interest rates rose greatly at the time. In addition, other costs such as food and fuel rose as well. People who bought their homes when interest rates were at an all-time low were forced to deal with rising mortgage payments.

But in recent years, prospective home buyers have opted for long-term, fixed mortgage rates that provided more stability. Currently, the financial sector isn’t expecting high rises in rates. But nevertheless, it’s smart to learn everything you need to know about Switzerland’s mortgages rates.

Urbanization is not as big as it used to be

The Covid-19 pandemic has created some long-term consequences that aren’t health-related. One of those consequences was that a majority of people have started working from home, and this trend of remote work has caused home buyers to look for properties outside of major urban centers.

These flexible work schedules are allowing people to look for accommodations in places that are much more affordable and further away from crowded places. Going even a few kilometers outside of big cities can lead to a significant price reduction for both houses and apartments.

Of course, this doesn’t mean that urbanization is completely gone, but it’s certainly changed from what it once was, possibly for good. And even though the pandemic will end one day, the behavioral changes that it made will most likely stick around for a while.

It’s safe to assume that working from home will still be sought-after, which will increase the demand for properties outside of urban locations. The immigration/emigration balance has shifted and while the Swiss residential population grew by 0.75% in 2020, that growth was only 0.3% in major urban centers.

The real estate market has already been affected by the Covid-19 pandemic, but cities are still the hotspot of cultural, economic, and social life. A lot of people will still want to live in urban cities and take advantage of what they have to offer, but not nearly as much as they used to.

While it’s still unclear what kind of stance Swiss companies will have toward remote work in the future, the chances of having more people who work from home seem quite high. Fewer people who are commuting to work will also reduce the ecological footprint significantly, which is a bonus.

Swiss real estate 1:0 Covid

In a lot of countries, the global financial crises were followed by a real estate slump after experiencing a big boom, but that’s not the case in Switzerland. Ever since 1998, there has been one value appreciation after another and residential property prices have been rising steadily.

This didn’t change even during the pandemic. Apartment buildings saw an increase in market value by 4.1% in 2021. But the situation was slightly different for commercial real estate. Many Swiss retailers had to close their stores. But still, the value of commercial properties increased by 2.7% in value in 2021.

If you look at the office space sector, you will notice that the pandemic has had a much less severe impact on it than most investors feared. Modern office spaces that have prime locations in big cities are still appealing to renters. Especially if they meet the latest environmental standards.

All in all, the underlying market is still relatively solid and vacancy rates have only increased in Zürich, Geneva, Berne, and Lausanne. So, it’s safe to say that the Swiss real estate market wasn’t affected by the Covid-19 pandemic nearly as much as other countries were.

Commercial vs. retail

The real estate dynamic in Switzerland becomes much more different when you go beyond the residential market. Retail has been dealing with years of oversupply. This is an issue that reached its peak around 2016 and came back in full force when the pandemic hit in March 2020.

When it comes to this sector, experts remain cautious. The view of the office market is generally optimistic, especially for high-quality office buildings in popular locations. However, it’s important to mention inflation as approximately 90% of rental contracts are indexed to it.

After dealing with oversupply, rental growth came back with a boom in 2019. But it’s expected that rents will fall very soon. In 2021, the vacancy rates have increased from 5.5% to 5.8%. However, it’s expected that will be offset due to a boost in the number of new jobs. Small and medium-sized businesses will probably start renting out existing office spaces in the near future.

Remote working and online shopping

Compared to more centralized countries, the Swiss office market is significantly more fragmented. This is due to the high number of small and medium-sized businesses that operate there. These companies typically have a workstation set aside for each employee, even if they’re hybrid workers.

Additionally, it’s important to note that a lot of large firms were already offering flexible work models long before the pandemic hit. This means that these organizations didn’t need to scale back on their office spaces.

As we already mentioned, the trend of remote work will probably stay alive after the pandemic is over. But most companies are considering adopting a hybrid work model. This means that their employees will spend a part of their time at the office and part working from home.

When it comes to retail and renting out spaces, online shopping has created some issues. The large-scale adoption of eCommerce shopping only increased during the pandemic. Therefore, the need for retail spaces is much lower and a decline in the prices of these spaces is expected.

However, it’s not the same for shopping centers, as their popularity remains as strong as ever.

Verbier real estate market

While it isn’t very easy to purchase property in Switzerland, many international buyers are taking every opportunity they can get, especially in popular resorts. One of these resorts is Verbier, and the Verbier real estate market is booming.

Homebuying in Verbier is very popular and outranks buying properties in other resorts. The Verbier real estate market has seen a growth of 2.9% in property prices. Now buyers are looking at the approximate cost of US$20,000 per square meter.

Nevertheless, those who understand the popularity of this resort are more than happy to pay the prices of the Verbier real estate market.

What are the future trends?

While it’s impossible to know what exactly the future holds, we can still make assessments. The trends that emerged in the Swiss residential market saw a renewed interest. The demand for large residential homes that are outside urban areas.

One good example of this is Aargau, which saw a 20% decline in residential vacancies. However, the complete opposite happened in the canton of Zürich. Here, properties in urban areas remain popular and people are still buying them.

If we were to guess, we would say that the real estate market in Switzerland will normalize within a few years.

Those who work from home will keep buying properties far from urban areas. However, people who are returning to the office and parents with children who are going back to school will stay in urban areas.

Final thoughts

While some investors think that buying property in Switzerland isn’t a smart move, visionaries know how to look beyond the crisis. Real estate trends in Switzerland show that people are still buying property. This happens despite the fact that urban areas might not be as popular now as they were before.

If you want to own Swiss property, you should consider finding out more about the Verbier real estate market. Anyone who wants to be a homeowner in one of the most popular skiing resorts in the world, check out the amazing real estate Verbier offers and you’ll fall in love with at least one property.